What is Medi-SIP ?

Dear Insured,

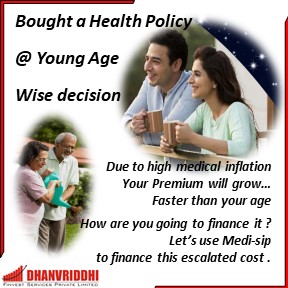

As you are aware that cost of medical treatment is going up day by day as so the premium of policy. Here is a table which provides an estimate of how your medical policy premium is going to be at respective age.

| Age | 30 | 40 | 50 | 60 | 65 | 70 |

| Premium | 15000 | 18000 | 25000 | 38000 | 46000 | 54000 |

We have solution which helps you to provide for these escalating premiums at higher ages.

So Even at age of 80 Years you can easily continue your Medical insurance Policy, unlike others who have not opted for Medi-SIP

If you wish to have your own Medi-SIP just provide us with following details..

Why Health Insurance ?

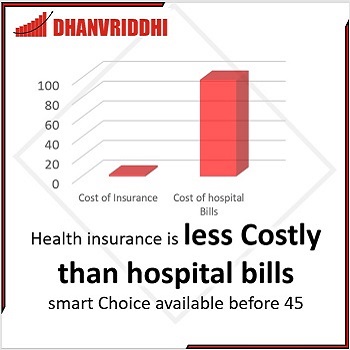

Insurance was an optional cover once upon a time. Now with rising cost of medical expenses it has became a necessity.

Cost of medical insurance is relatively low, if you consider the mounting cost of hospital bills.

Also many people refuse to buy the policy at young age, assuming the possibility of hospitalisation is least. however they put there wealth creating capital at risk by doing so.

Health insurance is a first step of every long term financial plan.

Special Plans – Some people who can not be covered under normal health plans can be covered under special plans.

Some of the Special Plans are

- Senior Citizen policy (60 to 75 Years for entry)

- Corona protection policy

- Diabetes Special

- Cardiac Cover This policy is specially designed for persons who have existing Cardiac diseases

- Cancer Cover First ever health insurance product for persons diagnosed with Cancer

Personal Accident

Under Personal accident policy insured is covered for

- Accidental Death

- Permanent disablement

- Temporary disablement

Mediclaim/Health Insurance

The most common policy is the Hospitalization expenses reimbursement policy or “mediclaim” policy as it is commonly known. This will reimburse “eligible” expenses incurred while hospitalized for treatment of any illness or disease or due to an accident. The policy normally does not cover expenses incurred outside the hospital even if they are quite high such as expenses for tests, doctor’s visits while not hospitalized or medicines during that period unless it leads to hospitalization in 30-90 days or is a result of hospitalization in the prior 30-90 days. Expenses on elective treatments such as cosmetic surgery, obesity, etc. are also not covered. There is a long list of other permanent exclusions but in the interest of simplicity they are not being given here.

Critical illness

There are policies that pay a lump sum if you contract a serious illness/disease such as Cancer, stroke, organ failure, etc. This amount is payable when the condition is diagnosed and you survive a fixed period after the diagnosis. This type of policy is popularly called a critical illness policy and it is supposed to be used to create a corpus to generate income to replace the loss of income that normally occurs after such condition is diagnosed and fortunately you survive. Critical Illness Policies are in addition to and not a substitute for mediclaim policies.

Hospitalisation cash Policy

policy which pays a fixed sum of money for every day spent in the hospital is called daily cash allowance policy and is again a supplement to and not a replacement for a mediclaim policy.

Topup Policy

- is extension to your existing Medi-claim policy of any company

- Applicable if cost of treatment exceeds basic exemption amount of policy

- Available for individuals or Family

- Available at affordable cost

Sum Insured of Rs.10 Lakhs for aged 45 Years @ 2800/- +GST (with define deduction of 3 Lakhs)

Porting of Mediclaim Policy..

- Porting is you change your insurer at renewal time

- Porting of policy offers all benefits of continued policy

- No claim bonus can not be ported with policy

List of Network Hospitals

![]()

![]()

![]()

List of Excluded Hospitals

![]()

![]()

![]()

Preventive Health check-up Network Labs

![]()

![]()

![]()

Claim Checklist

![]()

![]()

![]()

Claim Intimation & Process

![]()

![]()

![]()

Claims status check

![]()

![]()

![]()

Claim Rejection & Resubmission

![]()

![]()

![]()

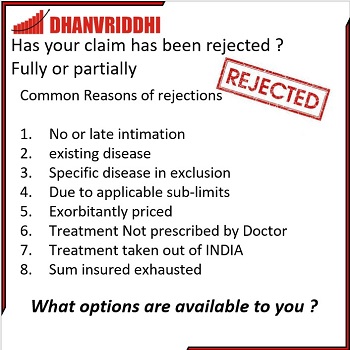

Has your claim been Rejected Fully or partially ?

here are some common reasons of rejections…

- No or late intimation

- existing disease hence in waiting period

- Specific disease in exclusion

- Due to applicable sub-limits

- Exorbitantly priced

- Hospital is blacklisted by insurance company

If it has happened, what is the option left with insured ?

Insured can still write to company claim department, & if he is not satisfied with company’s response insured can escalate to Insurance ombudsman / IRDA.

If you need we can guide you to take a suitable step..

Claim Grievances

![]()

![]()

![]()

What is e insurance ?

e Insurance Account (e IA) is the first step to powering your insurance policies. Once you have an e IA, you can buy and keep all your insurance policies from any insurer in electronic mode. You need to have only one e IA for all your policies and it comes with an unique e Insurance Account number. Each e Insurance account holder will get an unique Login ID and Password to access his account and electronic policy details online

you can view your policy details any time! You can pay premium for all your Insurance policies online and even log in service requests and complaints, if you have any.

If you already have insurance policies, you can convert your existing policies into electronic mode by submitting a request for conversion along with the application for opening an eIA. If you are planning to buy a new insurance policy any time soon, it’s best to open an e IA at the same time and opt for an electronic policy. Once you have an e IA, your documentation for buying a policy will be much simpler. So even if you are undecided about your policy, you can still open an eIA and quote your eIA number when you decide to buy a new policy!

Your policies remain safe and secure in our repository – so you have the peace of mind that you always desired! Download an e IA opening form now or you can fill out an application online!

That’s not all!! Opening and maintaining an e Insurance Account is absolutely FREE ( No fine prints , no shocks !! )

So, what are you waiting for? Open an e Insurance Account Now! And discover a whole new world of insurance policy service!